Since 2005 trustees have had to record in the statement of investment principles (SIP) their approach to social, environmental or ethical considerations when selecting, retaining and realising investments. For most this has been a tick-box exercise saying, for example, that they left this to their fund managers.

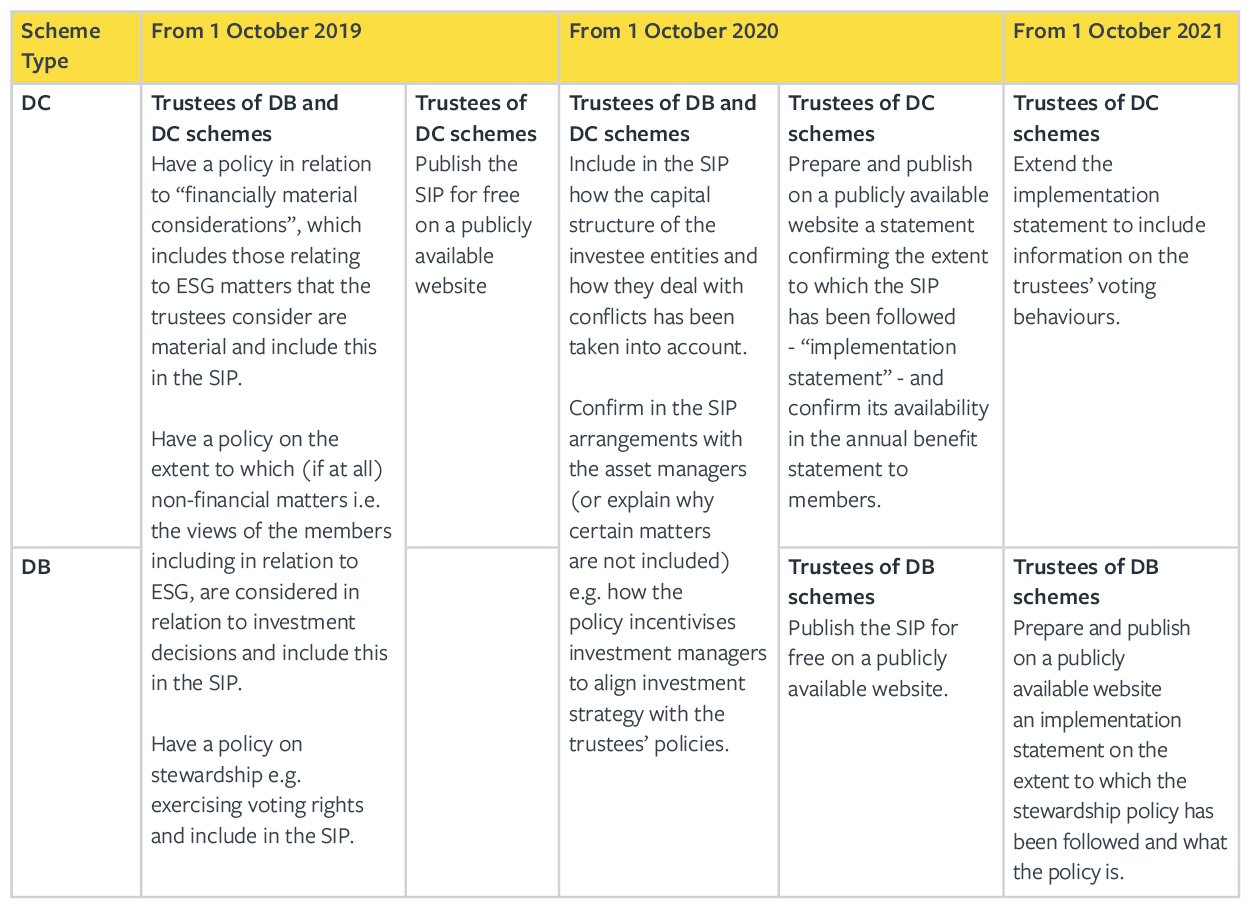

With growing focus on environmental, social and governance (ESG) issues, recent changes have been implemented to pensions legislation introducing new disclosure requirements in relation to pension scheme investments and the consideration of ESG issues.

With this growing focus many trustees are unsure how ESG should be taken into account when making investment decisions. In our view ESG should be seen as another risk factor - how much weight is given to it is likely to vary from scheme to scheme and the trustees’ attitude to risk. However, it can also be financially material.

What do the ESG requirements mean in practice?

Whilst previously considering ESG issues when making investment decisions was likely to be a fairly rudimentary process for most trustees, with the recent changes and the likelihood of greater Pensions Regulator scrutiny in this area trustees should be placing more emphasis on ESG issues going forward.

Although the additional documentation and disclosure requirements do add to trustees’ “to do” lists, having to take into account ESG issues when making investment decisions may well not be a bad thing. Instead we view the ESG requirements as another risk factor to be considered when making investment decisions and it could be a deciding factor between two investments if all else is equal.

There is evidence to suggest that good corporate governance can result in better performance. It would seem fairly obvious that companies with good ESG ratings are likely to be less risky investments e.g. the risk of environmental claims is likely to be lower, as are corporate governance issues that can impact negatively on the share price. But they could also offer better long-term value as they are likely to be more sustainable businesses in the changing world.